tax abatement definition for dummies

It also obligates these individuals to live or do business in the neighborhood in order to receive the full advantages that come with the tax abatement offer. Tax abatements are also designed to stimulate the local economy with the.

Abatement of Debts and Legacies is a common law doctrine.

. Its important to note some important terminology for the purpose of this article. Ad Free 2-Day Shipping with Amazon Prime. Depending on abatement structure used property might actually not be subject to property tax if property isnt taxable then some doors open 100 abatement or payments in lieu of taxes pilot payments contractual pilot payments are outside normal property tax rules.

Tax increment financing TIF is a financial tool used by local governments to fund economic development. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. Abatement is the proportional reduction of a legacy.

For instance local governments may offer abatements to cover the cost of building new infrastructure to. For example the Portland Housing Bureau says its tax abatement program could save property owners about 175 a monthor about 2100 a yearfor a total savings of 21000 over 10 years. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

Plan for the National Energy Modeling System. January 30 2014 Brigid DSouza. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

One method is called tax increment financing. In broad terms an abatement is any reduction of an individual or corporations tax liability. A reduction of taxes for a certain period or in exchange for conducting a certain task.

Tax abatement n Steuernachlass m. Define Abatement or Tax Abatement. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement.

Though the basic concept of TIF is straightforwardto allow local governments to finance development projects with the revenue generated by the developmentits implementation can differ in each state and city where it. The tax abatement is designed to make these areas more appealing to prospective buyers and developers. Check out our property tax calculator.

Trustees of simple trusts are names or dummies for. Examples of an abatement include a tax decrease a reduction in penalties or a rebate. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location.

It is not liable to withholding of income tax on salaries of its employees. In other words when your taxes are abated it means that your taxes are lowered. Essentially it means banking on the increase in property tax revenue that will result when the project is finished.

Get 247 customer support help when you place a homework help service order with us. Low Prices on Millions of Books. JUNE 9-16 2022 VOL.

What Is a Tax Abatement. Tax Abatement Meaning. The meaning of TAX ABATEMENT is an amount by which a tax is reduced.

Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Means a full or partial exemption from City of Fort Worth ad valorem taxes on eligible real and personal property located in a NEZ for a specified period on the difference between i the amount of increase in the appraised value as reflected on the certified tax roll of the appropriate county appraisal district resulting from improvements begun after. Mayor Fulop signed his abatement policy into effect by executive order on December 24 2013.

The government can fund a project by pointing to the revenue the project will generate once its complete. A sales tax holiday is another instance of tax abatement. Tax-abatement as a means A temporary suspension of property taxation generally for a spe-cific period of time.

Abatements can range in length from a few months to several years. If an individual or. The policy was a clear departure from his campaign pledge which included the promise to allocate abatement revenue to a dedicated non-discretionary account for education funding.

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis. Abatement is a reduction in the level of taxation faced by an individual or company.

For example a tax return is the document you file normally for income taxes and you might receive a tax refund if youve overpaid. This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge. Tax Abatements 101.

When you get a tax abatement the government is essentially giving you a tax break on certain types of real estate property business. The target audience for these programs is usually low- to middle-income residents.

Tax Abatements The Basics National Housing Conference

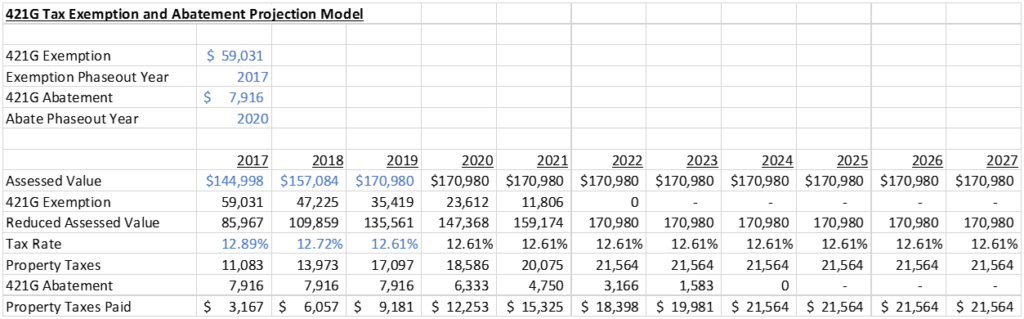

What Is The 421g Tax Abatement In Nyc Hauseit

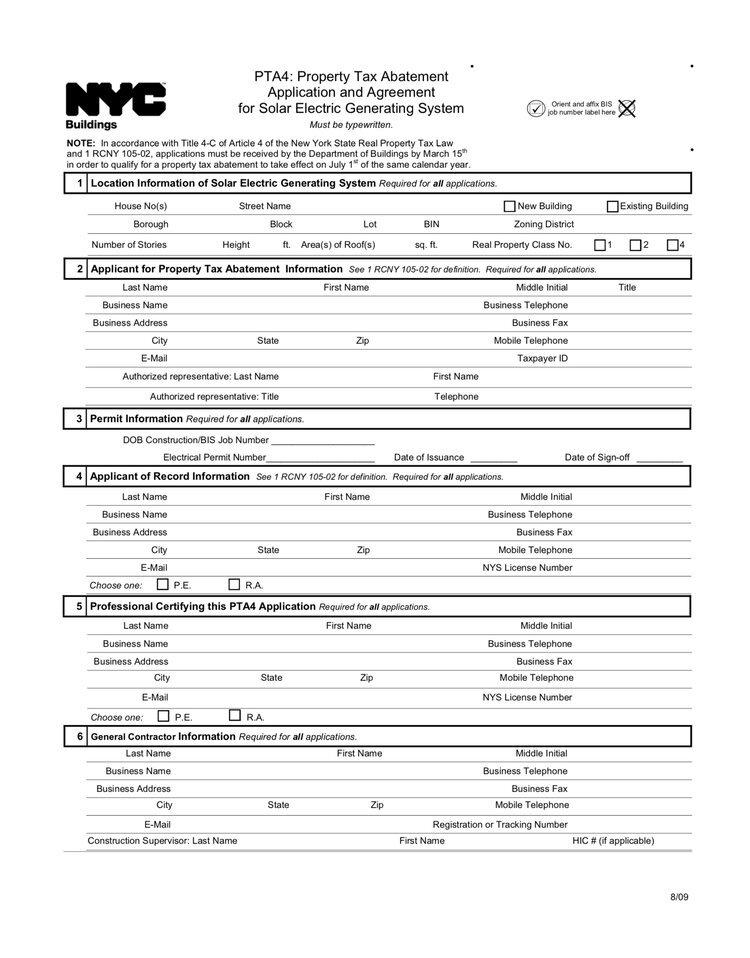

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

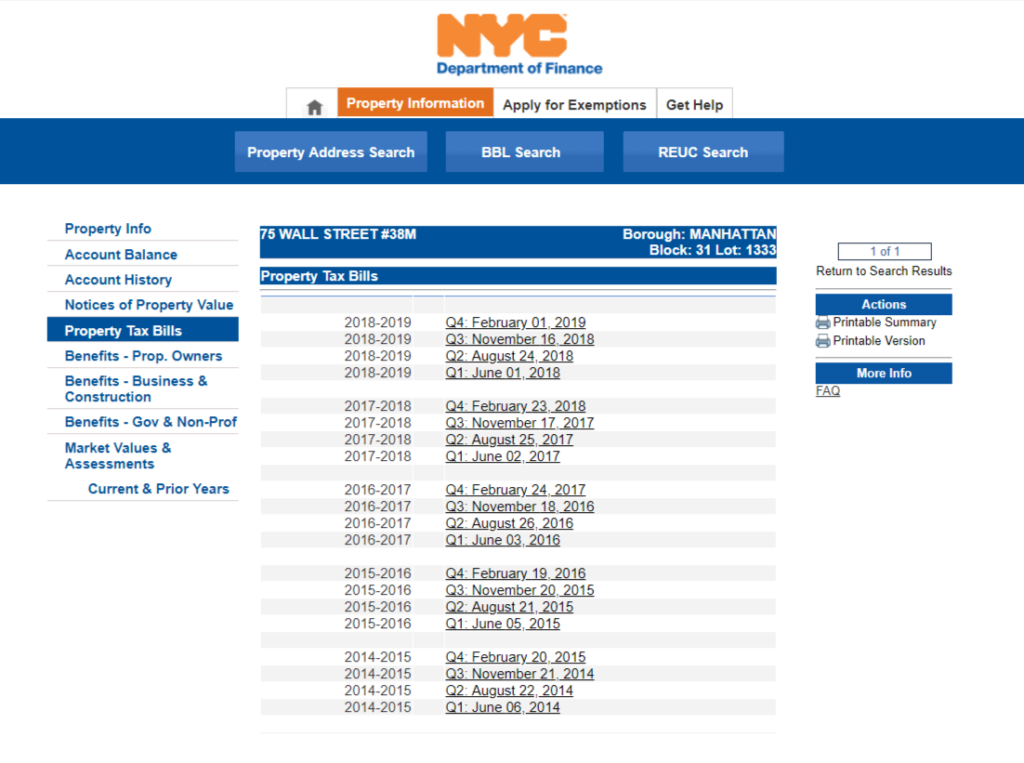

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

What Is Abatement Definition And Examples Market Business News

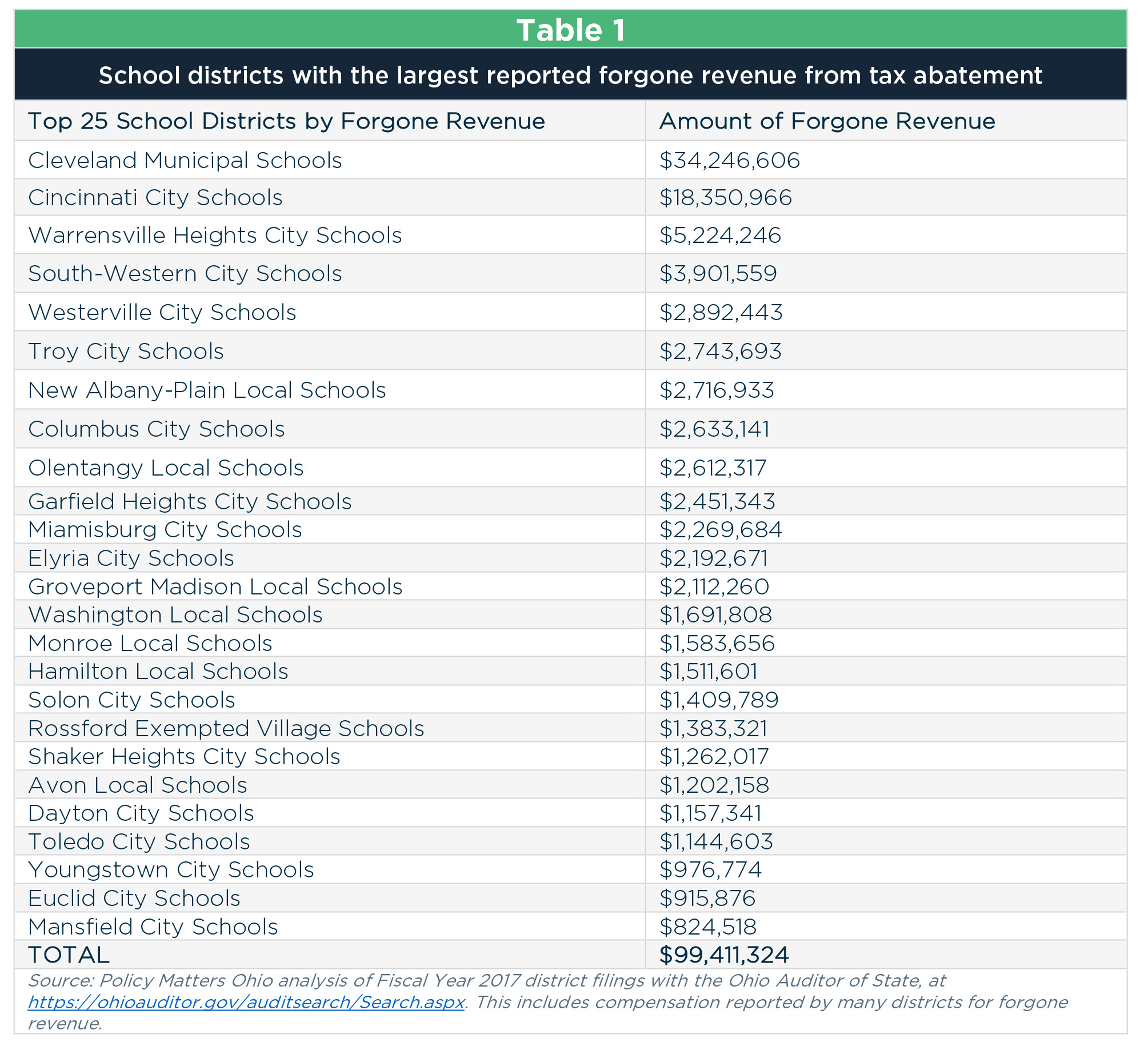

Tax Abatements Cost Ohio Schools At Least 125 Million

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

Tax Abatements Alabama Department Of Revenue

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo